Maverick County Taxpayer’s Reply to County Judge David Saucedo’s Response to Tax Rollback Petition Invalidation

Judge Saucedo,

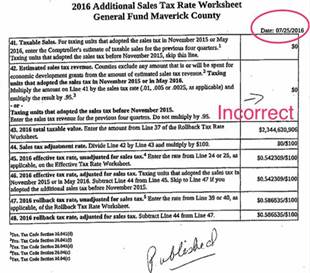

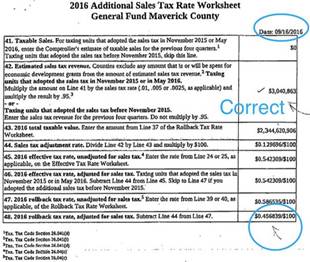

For the first time, I actually agree with you on something; you didn’t exceed the rollback rate that you published last summer, however, don’t you think it is misleading to forget to include the fact that the amount you published was WRONG? Attached are the two copies (incorrect and corrected versions) of the calculation worksheets that the Tax Assessor provided. So I ask, did you approve a tax rate higher than the correct rollback rate?

What about the fact that the Texas Secretary of State Office states that less than 2,000 signatures were needed for the petition to be valid when you said 2,166 were needed? Are you saying that because you were wrong in your calculations again the law does not apply?

When you say that services will be cut and people will be laid off, why is that so? By looking at the budget on Maverick County website it tells a different story. Page 5 says that this year you will have over $3,000,000 more in revenue in the General Fund compared to last year (Increased from $14 million to $17 million). How much revenue will you lose if the rollback election is approved? That is simple math. The

rollback will reduce the property tax rate from $0.54/$100 to $0.45/$100, or a decrease of $0.09/$100, so:

Property Values x Decrease in property tax rate = Decrease in Revenue

$2,344,620,906 x $0.09/$100 = $2,110,158.82

So again, by simple math, this means that you will still bring in almost $900,000 more than last year even if the rollback is approved. With more money than last year it is up to you as the Budget Officer if you want to cut services or lay people off, but do not blame the rollback election. The rollback process is only to correct your mistake. It is sad that you as a public servant have resorted to scare tactics and lies to your employees and the needy to cover-up your violations of the law. I will be glad to meet with any member of the Commissioner’s Court or any member of the public to show the truth and actually be transparent.

Ethelvina I. Felan,

Maverick County Taxpayer