Texas Border Economy October 2022 Summary

Joshua Roberson and Rajendra Patidar (Dec 23, 2022)

October 2022

Economic indicators along the border showed mixed responses for October. The payrolls expanded in all border Metropolitan Statistical Areas (MSAs), corroborated by decreases in unemployment rates and claims. Nonresidential construction activity has been growing, but residential construction remains sluggish. The reduction in trade activities led to an increase in the persistent trade deficit.

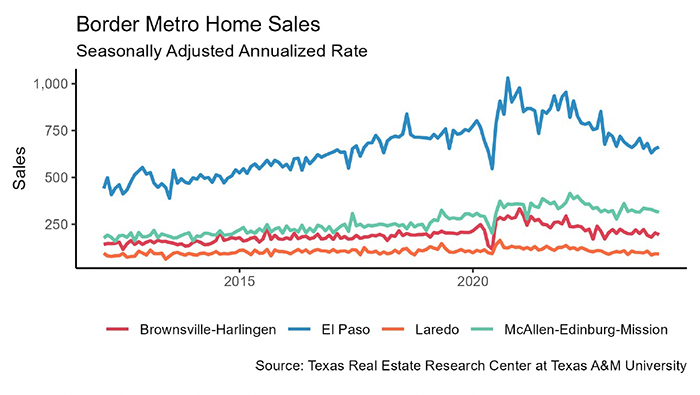

The decreasing trend in seasonally adjusted housing sales continued in October. The domino effect of plunging home sales in past months has led to a rise in days on market and inventory and a reduction in median home prices. The global impact of the war in Ukraine is disrupting energy markets and impacting the cost of living and purchasing power. Inflation was lower than expected after a slight decline from September, but consistent price increases in food, energy, and housing have been troubling for consumers, despite some recent improvement.

Economy

The Dallas Fed’s Business-Cycle Indexes indicated moderate growth, though it was slower than last year when the border was recovering from COVID-19-related shutdowns. In the Rio Grande Valley, both Brownsville and McAllen reported a seasonally adjusted annualized growth of more than 3.2 percent, while the metric grew by 1 percent in Laredo and El Paso. Both pedestrian and personal vehicle crossings were up 30 percent over year-ago levels after restrictions were lifted in 4Q2021.

Overall, border nonfarm employment added 2,400 positions due to a hiring expansion in McAllen metropolitan area (1,000 jobs). Meanwhile, El Paso and Brownsville each added 600 positions. Sectors like trade, transportation, manufacturing, and hospitality were major contributors to employment growth in the border region.

The spike in jobs led to the lowest unemployment numbers since the onset of COVID-19. The border region’s unemployment rate fell to 5.7 percent in October. Joblessness in Laredo and El Paso was at less than 5 percent, while it fell to 7.2 and 6.2 percent in McAllen and Brownsville, respectively. The labor force participation rate ticked down statewide, while weekly unemployment claims declined across border areas.

Fluctuations in the average private hourly earnings revealed negative growth along the border as wages fell in all metros. Consequently, inflationary pressures prevented meaningful gains in purchasing power. Earnings in McAllen were down in real terms to a nominal wage of $19.10, while in Brownsville they remained at $18. Hourly wages in Laredo and El Paso inched down to $19.65 and $22.65, respectively, from September’s all-time high. Nominal wages grew significantly in the first half of the year and surpassed pre-pandemic levels.

On the southern side of the border, Mexican manufacturing and maquiladora employment1 continued the upward trend with the addition of 1,090 jobs in September. The increase in Mexican manufacturing employment was driven by growth in Reynosa and Chihuahua. Here is the summary of maquiladora employment in September.

Global supply chain pressures increased moderately in October after five consecutive months of easing as indicated by the Federal Reserve’s Global Supply Chain Pressure Index. Supply chain pressures were significantly below year-ago levels and are expected to decline further.

The S&P Global Mexico Manufacturing PMI for October indicated a slowdown in persistent contractions in the Mexican manufacturing sector as inflationary pressures, cashflow problems, and material shortages dampened demand.

In the currency market, the peso per dollar exchange rate averaged $19.982. After adjusting for inflation, the metric decreased over the month, revealing gains for Mexican importers. Also, the rise in real effective exchange rate (REER) indicated a loss in trade competitiveness for United States exporters. The total trade value decreased, and the widening gap between imports and exports in October resulted in an increase in the persistent trade deficit. At the metropolitan level, El Paso’s and Brownsville’s exports were higher, while Laredo’s and McAllen’s higher imports contributed to a large part of the trade deficit.

Real Estate

Construction activity went up in October due to a rise in construction of retail space, offices, and houses. Changes in residential and nonresidential construction values varied across border areas. The construction of retail, offices, and schools boosted nonresidential construction values in El Paso by 28 percent year over year (YOY) while values declined in Laredo by 35 percent YOY. Meanwhile in the Rio Grande Valley, commercial construction activity in Brownsville and McAllen improved by 36 and 126 percent, respectively, YOY. Residential construction activity has been stagnant from the last two quarters as indicated by the reduction in values and permits issued.

The pessimism in the housing market continued as overall housing sales declined sharply by 14.6 percent in October. The metric was down by 17.2 percent in both Brownsville and El Paso. Sales dropped by 15 percent in Laredo, but the metric went up by 45 percent in McAllen. Housing sales this year have relied heavily on mortgage rates, and Freddie Mac’s 30-year fixed rate was 6.9 percent in October, the highest in the last decade from a record-low 2.7 percent in January 2021. Consumer buying behavior has changed in the last few months with concerns about rising mortgage rates and inflation.

Border metros issued 610 single-family housing construction permits, down by 12 percent from September. The continuous reduction in issuance of new projects in border metros will have consequences on the region’s housing markets. On an annual basis, the number of total permits issued was less than the previous year as all major metros except Brownsville reported a decline. Despite declines in permit counts and values, the average value per permit remains elevated compared with pre-pandemic conditions.

Declining sales in previous months led to a rise in months of inventory (MOI) along the border, though the metric remained much lower than the typical six-month MOI benchmark. Laredo’s declining sales activity and a downtick in new listings pushed the average MOI for October to 2.7 months. El Paso’s metric rose to two months, while McAllen’s metric increased to four months, and Brownsville’s inventory stabilized at 3.14 months. These increases indicate inventory is growing primarily due to a decrease in home sales and an increase in listings.

The average number of days on market (DOM) for October increased across the border as reduced demand in the last few months led to a rise in inventory and a change in consumer buying behavior. However, the metric remained exceptionally low compared with year-ago levels. McAllen’s DOM reached 55 days from 50 days in August. Laredo’s DOM moved up to 38 days, while new listings in Brownsville and El Paso pushed the metric toward two months to complete the sale.

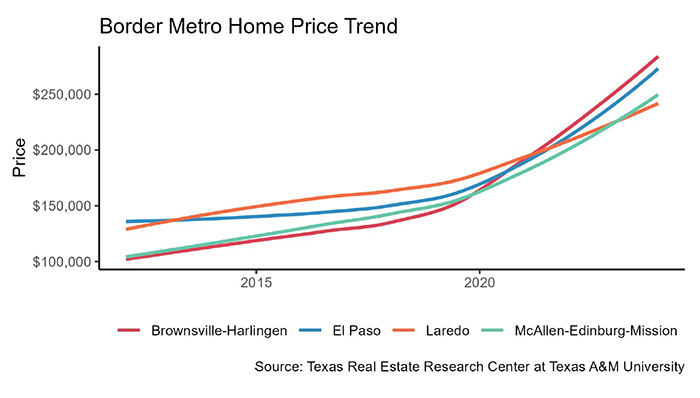

Reduced demand dented the median home price across border regions in the last couple of months, but the metric increased in October. In the Rio Grande Valley, the metric for McAllen and Brownsville metropolitan area dropped to $220,461 and $214,935, respectively. El Paso’s median home price was around $240,690, reporting a significant drop. Similarly, Laredo’s median price decreased from $220,461 in September to $215,000 in October. The border region’s housing market is known for its affordability, a factor that has attracted many buyers from other areas.

Mortgage rates play a pivotal role in determining housing prices and sales, and they will influence the border region’s future home price stability.

____________________

1 Mexican manufacturing and maquiladora employment are generated by the Instituto Nacional de Estadística y Geografía. Its release typically lags the Texas Border Economy by one month.

2 The real peso per dollar exchange rate is inflation adjusted using the Texas Trade-Weighted Value of the Dollar.